AZURE Minerals Ltd (AZS) done on the 16 Sept '23

Their recent share purchase plan was launched to raise $120m. Offered at 2.40 price now $2.84. Purpose for SPP:

• to accelerate exploration and resource drilling at Andover as the Company advances towards announcing a maiden lithium Mineral Resource targeted in Q1 2024.

Still an exploration company, but with a very large market cap $1b2. This is purely based on drilling results. Big red flags.

Have done none of the formal mineral studies yet.

Red flags. What is needed:

1.1 Resource

• Measured and Indicated (second drilling program with more narrowly spaced holes)

• Inferred (first drilling program)

1.2 Reserve

• Proven (after feasibility study proves measured economic)

• Probable (after feasibility study proves measured and indicated economic)

Therefore, estimated resource value is not available. Haven't done a scoping study, which is part of pre-feasibility studies.

What is planned:

-Mineral Resource Estimate in Q1 2024

-Scoping Study in 2024

Conclusion:

-It is still a long way before mineralisation gets proven.

-Also, a long way to get to the Definitive Feasibility Study (DFS) & FEED stage (2 -3 years subject to drilling programs)

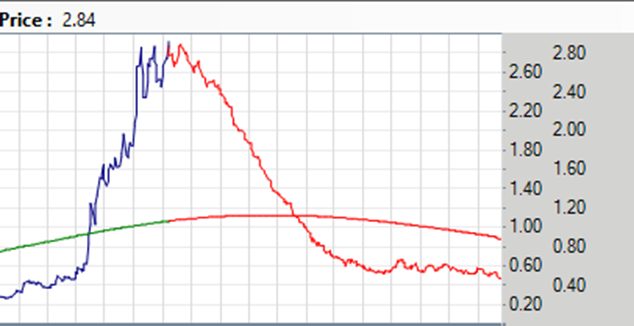

**My view: Once investor realisation sets, this price will plummet.

If we believe what Fourier says, then the future price looks very bleak. May be a good time to sell.

Edited: 1 Nov 2023

Interesting that SQM make an off-market offer to buy AZS on the 26/10 and then Hancock purchase on the same day 80m shares at nearly full price. Why is it important to be the majority shareholder - what is the strategy behind it? We won't know but can only speculate. The deal is subject to that no one else acquiring greater than a 19% interest in Azure. This may be an indication. Perhaps force SQM to come with a better offer?

Nothing substantial has changed from a rock value perspective, and the outstanding scoping study in 2024 still holds. Fourier still shows the price will decrease but obviously from a higher base. I will only look at it next year.