Cross reference Risk, Assets, Knowledge and Tools

A survey suggested the reason some people aren’t self-directed investors is because they believe it's like gambling; it's only for experts or don’t have enough time or money. The survey asked investors what their main underlying fears are.

The top fear was the lack of financial literacy/education followed by paralysis by analysis/overwhelming of choices

We may have enough financial knowledge but don’t recognise it. The 10 key financial fundamental concepts to understand is:

Budgeting and Cash Flow Management; Saving vs. Investing; Risk and Return; Diversification; Time Value of Money; Asset Allocation; Understanding Stocks and Bonds; Compounding; Taxation and Tax-Advantaged Accounts; Financial Statements and Valuation.

Problem: Human behaviour is such that we want maximum returns enduring the least risk and with minimum effort and time.

Question: Is there an optimum way of achieving a solution that will give optimum returns while enduring the optimum risk and with optimum effort and time?

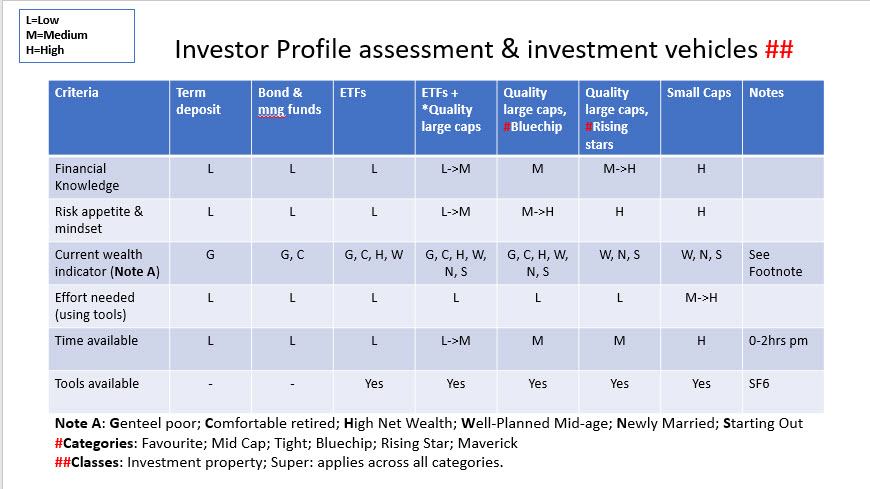

Approach: We employed a cross-reference table to better illustrate a solution involving many variables. The solution will be different for every person and their current financial situation.

Solution: The key is to apply the right knowledge and tools for the problem at hand, for a specific situation. Often, we overthink the problem because of an overload of useless information.