Easy way to maintain a quality share portfolio

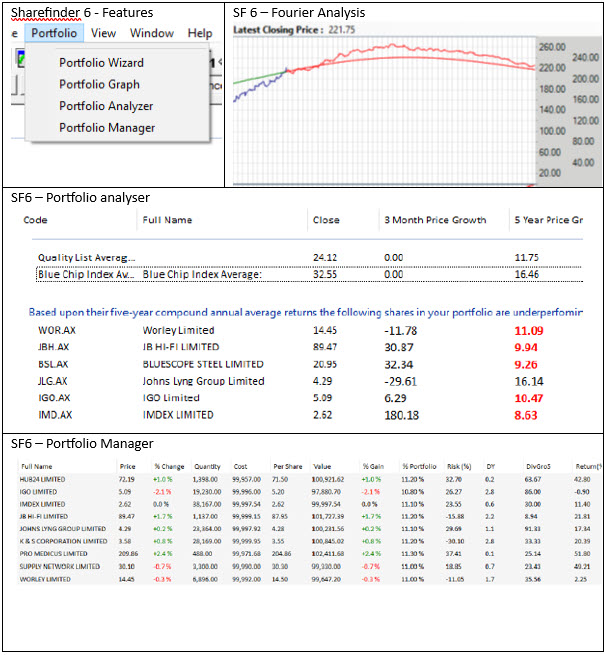

The ShareFinder application has many smart features and makes this process easy. The SF6 Portfolio Analyser evaluates the selected shares and makes recommendations.

Initially, once you have selected and purchased the shares, enter them into the Portfolio Manager. The Portfolio Manager will monitor the performance of the shares and make recommendations. That is smart and will save hours of work. It's always wise to interpret the results and not follow blindly. The shares selected may still be at the start of the new economic growth cycle. So, during the analysis, the application may see the shares as underperforming, as the shares didn't have time to grow.

That is exactly the reason you should confirm doing your own analysis on the recommended shares.

The application tracks the performance of the portfolio over time and shows when the shares run out of steam.

By using Fourier analysis, the application offers a quick view of what the future projection of the share's price growth looks like. For example, at the time of writing, PME did extremely well. Bought in June 2021 at $45.85, and at the date of writing, it shows a price growth of 357% at $209.86. This gives a compounded growth rate of 45% per year over 3.5 years.

Checking when the share would likely run out of steam soon, using Fourier analysis, the redline in the graph shows that there are a still a few months of growth left.

How to prune your shares:

a. Use Fourier analysis to see expected downturn

b. Then skimming the cream (leave the initial cost)

c. Sell the share over three tranches as you cannot determine the exact turning point

d. Invest in the next quality share