Company life-cycles

If we look at the lifecycle of a company, we can divide it up into the early startup phase, late startup phase, infant stage, early growth phase, growth phase, late growth phase, a maturity phase, decline phase and death.

The price of a small-cap share is directly related to the maturity and earnings of the company. Small caps can often give 100% and more price growth per year is not uncommon. However, getting 100% losses is also not uncommon.

Problem statement:

Small caps and penny stocks stay in a startup phase for a long time. From past experience, finding the fastest growing stock is difficult and depends entirely on the expertise of the management team, their strategic plan and insight into the industry. There is no easy way to track the historic successes of the leadership team. What alternative ways are there to find and pick fast growers.

Looking for patterns

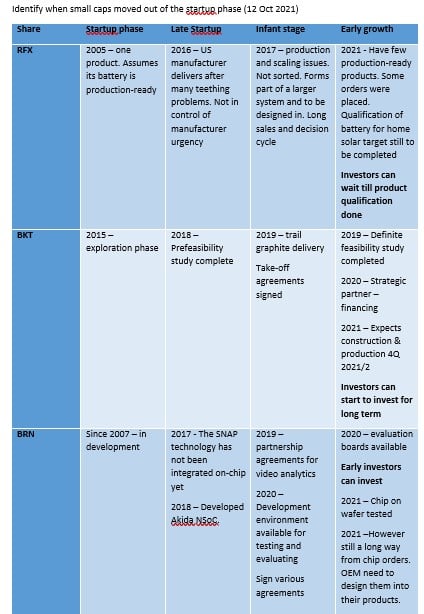

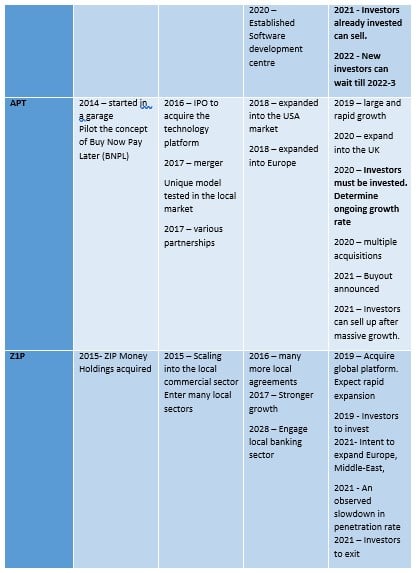

For a start, we need to know when companies are out of the startup phase. What are the signs to look for? See attached

Observe the small caps we have reverse engineered (RFX, BKT, BRN, APT, Z1P). When did it become apparent that the company is out of the startup phase, and moving into other stages?

Signs to look for

The company must have a well-defined and clear strategy, easy to understand and transparent.

The core business activity should be easy to follow.

Each sector and industry have their own unique development cycle and activities.

The share price grows as the company becomes more of a reality.

Well-planned startups will use owners' equity for the early development phase.

Once the startup wants to go into operations it will need plant and assets to produce what needs to be produced.

That is when funding is needed to purchase and implement assets. The financial structures are debt-based.

No dividends should be payable as all profits should be reinvested to grow the company.

The earlier, the cheaper the share price but the higher the risk of no production.

If you plot the events on paper it is easier to observe patterns within the cycle.

Note that the cycle for mines are different and here we should refer to the Lassondo curve.