LionTown (LTR)

A question was asked why Hancock increased their stake with ~10% on 11Oct'23

My quick napkin check:

In the final stage of construction and in operation mid 2024.

Book value at $1.7b and mark cap $6b.

But we need to estimate the resource value to see if over/under valued.

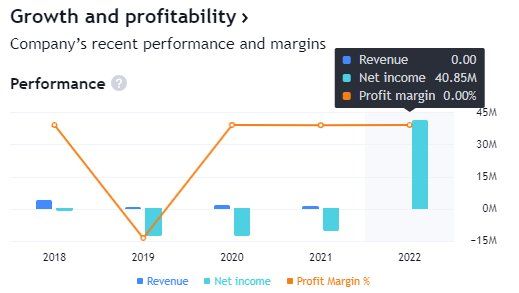

Also, expect $65m revenue in 2024

Valuation estimate

-The Lithium price depends on the grade.

-Risk allocation: Reserved = 100%; Measured & Indicated = 40%; Inferred = 10%

-Assume +70% net recoveries

-Assume $3,500 a tonne for 6% concentrate FOB Australia in Sept ’23.

Not sure what is the all-in-cost as not seen anywhere, but assume 50% opex/capex recovery costs

The JORC reports gave the mineral resource as measured, indicated, reserved. Note no value for reserved.

**Katheleen: (20mt x .4) + (109mt x.4) + (27mt x 0.1) = 54.3mt

**Buldania: (9.1mt x 0.4)+ (5.9mt x 0.1) = 4.23mt

Total: 58.3mt x 0.7 = 40.97mt

Gross Value estimate: 40.97mt x $3500 = $143b

Estimated Value: $143b – 50%(capex&Opex) = $71b

Therefore, the mine is under valued against a market cap of $6b

When another mining company offers a buy out, they seldom will offer more than 5-10% of the resource estimated value (as many costs are excluded in the napkin approach). Therefore, perhaps 3.5b - 7b is more realistic. Is the share still undervalued?

Also, as there is no cashflow, you cannot use the future discounted cashflow values to determine the estimated value of this mine.